Online transactions have revolutionized how people send and receive money, but they’ve also given rise to a significant increase in scams. GCash, a popular e-wallet app in the Philippines, provides convenience but can also be a vector for fraud. The lack of awareness on how to get back money from GCash scammer perpetrated through GCash is a pressing issue for many users, particularly given the sensitive nature and financial impact of these events. In this comprehensive guide, we’ll take you through the essential steps to take if you become a victim of a GCash scam and how to increase your chances of reclaiming what’s rightfully yours.

The Rising Threat of Online GCash Scams:

Today’s tech-driven world offers countless conveniences, from instantaneous financial transactions to virtual marketplaces at our fingertips. However, it also breeds a new strain of thieves that operates in the digital shadows. These scammers prey on unsuspecting individuals through clever ruses, often leaving a devastating financial and emotional toll in their wake. The landscape is more treacherous than it used to be, with scams becoming increasingly sophisticated.

A Personal Story:

I, too, was once ensnared in the web of an online scam. Apprehensively navigating the digital waters in the pursuit of brightly lit concert tickets, my venture turned nightmarish as I encountered a counterfeit transaction that drained my GCash account of a substantial sum. The loss was not merely monetary; it was a trust shattered in the pixels of my smartphone’s screen. With a fervent resolve to regain what was lost, I ventured forth into uncharted domains of the reporting process.

Method #1: Reporting the Scam within the GCash App

The immediate fallout of realizing you’ve been duped is shock, swiftly followed by outrage and a potent mix of fear and uncertainty. The first beacon of hope lies within the very app that facilitated the transaction.

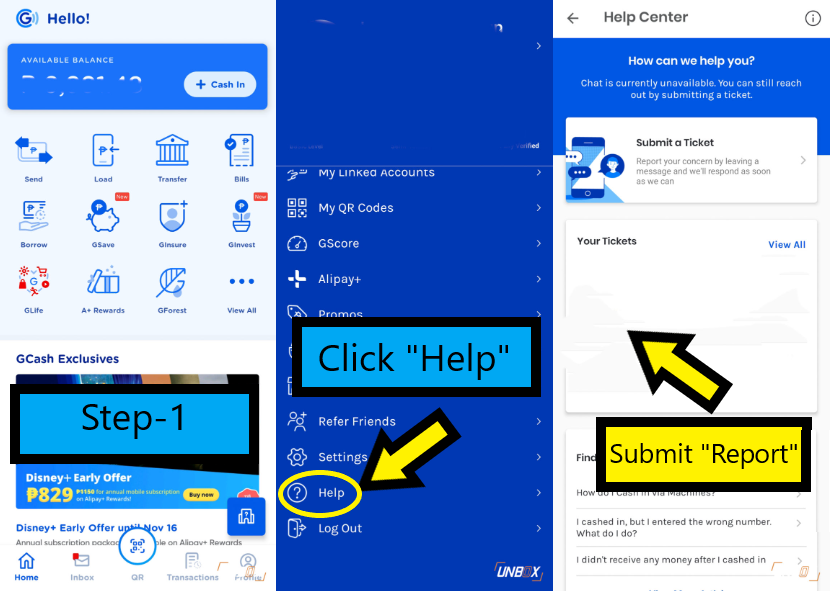

1 – Step by Step Reporting:

Within the GCash app, reporting scam through GCash requires a deft hand and a keen eye for detail. The first step is to locate the transaction in question and initiate a report. This begins a vital chain of actions that can lead to a possible refund and the temporary disabling of the scammer’s account.

2 – What You Need to Report:

The report is not a mere formality; it’s a dossier of evidence. Clear screenshots of the fraudulent transactions, along with any correspondence with the scammer, are the vital components of this archive.

3 – Temporary Disabling of Scammer’s Account:

Once GCash acknowledges the report, there’s the distinct possibility that the scammer’s ability to perpetrate further misdeeds is curtailed. This small victory not only serves justice but also prevents others from becoming victims.

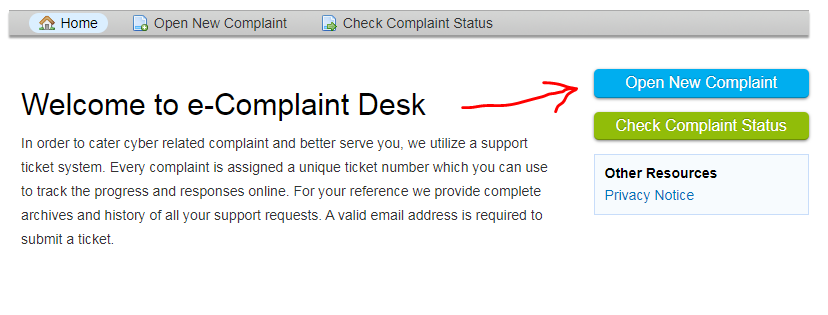

Method #2: Filing a Report with the PNP Cybercrime Unit

GCash is not the final arbiter of justice; that honor falls to the Philippine National Police’s Cybercrime Unit. You can also submit an online E-complaint on https://acg.pnp.gov.ph/eComplaint/ as shown below image:

The Importance of a Police Report:

Engaging the PNP Cybercrime Unit transcends mere transactional resolution; it escalates the issue and may lead to criminal charges against the perpetrator.

Locating the Nearest PNP Cybercrime Office:

Navigating the physical world can be disorienting after the digital entrapment, but persistence and guidance can lead you to the doors of the PNP Cybercrime Unit.

Step-by-Step Filing:

At the Cybercrime Unit, you will be required to provide an exhaustive account of the scam in a written report. The more granular the details, the better the chances of a fruitful investigation.

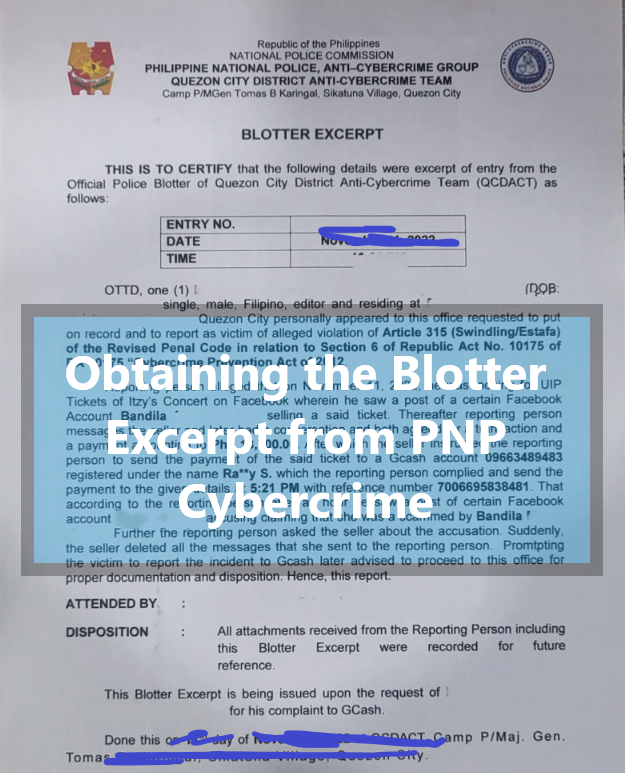

Obtaining the Blotter Excerpt from PNP Cybercrime

The Blotter Excerpt is akin to the golden ticket in GCash’s investigation process on how to get back money from GCash scammer, and it’s obtained through the completion of the Police Report with the Cybercrime Unit.

Its Role in GCash’s Investigation:

This document, furnished to GCash through your reported ticket, signifies the legal gravity of the situation and moves the refund process forward.

Process of Acquisition:

It involves filling out paperwork at the PNP Cybercrime Unit and ensuring that all relevant details of the scam are meticulously documented.

Sending to GCash for Action:

Armed with the Blotter Excerpt, you will submit it to GCash, connecting the dots between virtual and governmental channels.

Follow-Up and Conclusion

The investigation is an exercise in patience; the waiting game commences as GCash pores over the blotter and evidence.

Awaiting Updates:

Updates will trickle in, perhaps sparingly, but each notification is a sign that your case is moving through the labyrinthine process.

Addressing Common Queries:

The refund may seem elusive, and the apprehension of the scammer is a distant fantasy, yet the seriousness of eWallet apps in dealing with such cases should not be underestimated.

Tips for Avoiding Future Scams:

Educate yourself and others on online transaction red flags. Physical meetings and the sanctity of transaction receipts can serve as a bulwark against future scams.

In Conclusions:

Emerging from the depths of a GCash scam is not only a tale of personal perseverance but also a roadmap for all who traverse the same path. The digital age has yielded new threats, but it’s also a beacon of connectivity, sharing, and empowerment. Your virtual wallet holds not just currency but the promise of a community united against the specter of online malfeasance.

This compendium of guidance is a testament to the potential within each victim to transform their plight into one of progress. While the bureaucracy of reporting and reclaiming funds from a GCash scam may at first appear daunting, it’s a bridge that unites the individual’s narrative with the collective struggle against fraud. Remember, the steps outlined here are not just transactions in time and effort; they are investments in the future of secure digital interactions.

By the way, you are already using GCash, so today you landed on this blog post by searching the internet, so I have a gift for you. Yes, if you want to make money online using your own GCash account by playing games, installing apps and completing tasks, completing surveys you should try to read all these methods that I have listed in my post in which I have listed legit paying apps that give you earning in GCash in the Philippines.

Frequently Asked Questions about Scam Reporting on GCash:

In the unlikely case that you fall victim to a GCash scam, you should act quickly to stop communication, record all transactions, change your passwords, and report the incident to GCash.

Secondly, you can also get in touch with law enforcement, such as the National Bureau of Investigation or the Philippine National Police, and give GCash the information they need to look into the matter further. This will lessen the risk of fraud in the future and safeguard your financial information.

Unfortunately, for security and privacy concerns, it might be difficult to track down GCash scammers directly. But you can also:

1 – Send a report to GCash. Give GCash the details so they can look into it (the method is explained in the above article with details).

2 – Speak with Authorities: Involve appropriate authorities, such as the NBI or PNP (The method is explained in the above article with details).

Report GCash scams to local law enforcement (PNP) or the National Bureau of Investigation (NBI). Provide them with relevant details about the incident.

To submit a ticket, use the GCash Help Center or give their customer service a call at 2882. Report any suspicious activities or unlawful transactions right away.

Go to the GCash Help Center and fill out a ticket with the necessary information. You will be guided through the procedure by GCash Support. By the way, all methods are discussed in the above article on how you can report any suspicious activity to the GCash team by using the GCash app from your mobile phone.